News Headline June 29, 2011

How Direct Wine Shipments Are Changing

Annual report by ShipCompliant and Wines & Vines about $1.2 billion market shows many strengths

by Jim Gordon

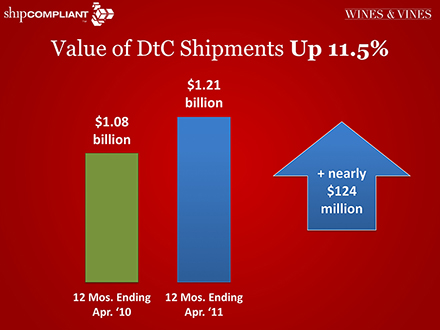

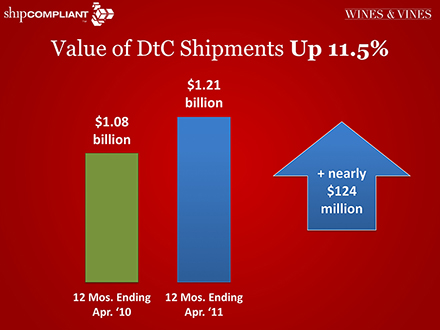

Direct-to-consumer shipments of US wine grew by more than 11% in the 12 months ending in April.

Napa, Calif.—The overall news about direct-to-consumer wine shipments presented yesterday at ShipCompliant’s annual conference was very good for U.S. wineries. Both volume and value of DtC shipments were up by more than 11% over the previous year. Digging deeper into the data provided by ShipCompliant and Wines & Vines revealed where the many successes—and a few disappointments—in sales performance occurred.

DOWNLOAD THE PRESENTATION

Click here to view slides from the presentation in PDF format.

Wines from Napa Valley remained the biggest selling items in the 12 months ending April 2011. Napa Valley’s favorite varietal, Cabernet Sauvignon, was the most popular varietal shipped and earned the most dollars per bottle.

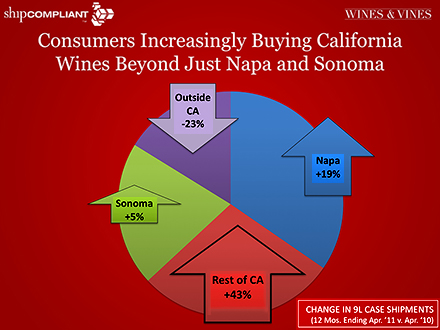

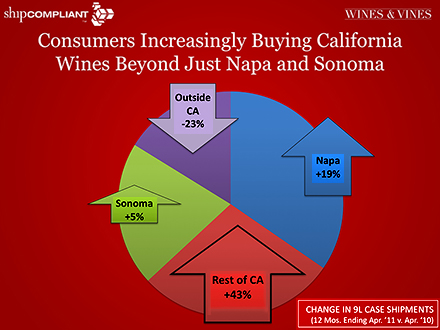

More surprising was the news that California wines from outside Napa and Sonoma counties enjoyed the fastest growth rate of all regions presented: 43% higher in case volume than the previous year. Also, the fastest growing wine varieties for DtC shipments included some of those previously considered less exciting, notably Sauvignon Blanc, sparkling wine and the oft-maligned Merlot.

Marc Engel presented data about direct-to-consumer wine shipments Tuesday in Napa. To watch his presentation, click on the photo above.

Bars and pies

Marc Engel, founder of Engel Research Partners in San Bruno, Calif., presented the results to 400-plus attendees at the all-day ShipCompliant Direct Shipping Seminar & Users Conference. Drawing on his 20-plus years of experience in market research for wine and other luxury products, Engel showed a 37-slide PowerPoint presentation and interpreted dozens of pie graphs, bar charts and maps for a crowd composed largely of winery staff.

The results came from the ShipCompliant/Wines & Vines Shipment Model. The model takes millions of DtC transactions handled by ShipCompliant for its winery customers and analyzes them in conjunction with Wines & Vines’ exhaustive database of 6,900 U.S. wineries. Overall results showed the entire DtC shipment market at 2.75 million cases worth $1.2 billion, spread among wine club, Internet/phone sales and tasting room purchases shipped to homes by the wineries. The data do not include tasting room carryout sales, which remain larger in case volume than direct shipments.

Engel painted the big picture first: Volume in 9-liter cases went up nearly 300,000 cases or 11.6% from May 2010 through April 2011—an increase of 11.5% in value, or nearly $124 million. The pace of DtC shipment growth more than doubled the growth rate of retail sales.

DtC growth was exceptional compared to the rate of U.S. wine production from May 2010 through April 2011. California wine production, estimated at 90% of U.S. production, grew just 1% in volume.

The average bottle price for DtC shipments remained steady at $37. Nearly every price-point increased in case sales during the 12 months, especially in the lowest and highest ranges, but sales slipped by 7% in the $20-$29.99 group. Wines under $15 shot up in sales by 34%, and sales for those priced at more than $100 rose 16%.

One dramatic change from last year was the high rate of increase in DtC shipments from the largest wineries. Direct shipments from producers of 500,000 cases or more increased by 168% from a small base. On the other end of the winery-size scale, wineries producing 1,000 or fewer cases saw a decline of 41% in case volume of DtC shipments.

Cabernet still king

Cabernet Sauvignon remained by far the favorite varietal choice, with a 27% share among the 11 specified varietal categories. Pinot Noir was next, followed by Chardonnay, Zinfandel, Syrah and Merlot in that order. From a large base, Cabernet grew 31% in volume and 28% in value.

“Cabernet has succeeded phenomenally,” in market share and bottle price, Engel observed. “It was by far the most expensive varietal shipped to consumers.”

Both sparkling wine and Sauvignon Blanc grew even faster than Cabernet Sauvignon, from small bases. Of the major varieties, Sauvignon Blanc had the lowest price per bottle at $23, while sparkling wines averaged $35.

Engel showed which states receive the most DtC shipments. California was the leader by far with 32% of the market, followed in order by Texas, New York, Florida, Illinois and Washington. The fastest growing states were Georgia, Connecticut, California and Ohio.

Geographical origin of the wines shifted in significant ways during the measured year. While shipments from major California regions increased, wine shipments produced in other states decreased by 23%. Shipments from Napa Valley and Sonoma County were reported separately; another category combined results from the rest of California.

The pie slices indicate DtC shipment market share by producer region. The "Rest of California" region grew fastest.

This “rest of” component grew 43% in volume, indicating that consumers are increasingly interested in wines from regions like Santa Barbara, San Luis Obispo, Monterey and Mendocino. In a comparative

analysis of top varietals, the rest of California showed higher growth rates than both Napa and Sonoma in five of six categories.

Napa wines continued to lead the bottle price data with an average of $52. Sonoma was second at $36. Average price from the balance of California was $26; outside California it was $22.

415.453.9700 | Fax: 415.453.2517

info@winesandvines.com