Retail Wine Sales Grew Faster in May

U.S. wines up 7.1% over last year; top Washington brands ranked

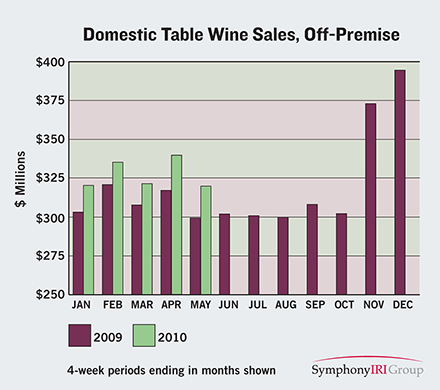

Even though that total for monthly sales ending in May was lower than the total for April, the Wines & Vines monthly chart for domestic wines sales looks very positive. California, as the dominant wine-producing state, had the same sales rate as overall domestic sales. Washington, the second-biggest producer, moved ahead too, but at a slower rate -- just 3.8% higher than the same four weeks last year. Later in this article and in the accompanying table, Wines & Vines presents a closer look at Washington’s top 20 brands based on IRI data.

Contrary to the prevalent story about consumers trading down in the recession, evidence is building that consumers are trading back up, according to IRI’s Doug Goodwin, vice president of client insights for beer, wine and spirits.

All price-points up to and including the $20-plus range for 750ml bottles showed higher sales in May 2010 than in May 2009, except for one: wines under $3. The highest priced wines showed the fastest growth rate of 23.1%. “Looking at those numbers, I think people went down, and now they are migrating back up,” Goodwin said.

Syrah and Sauvignon hottest

Even the biggest category, with the most inertia—wines from $5 to $7.99—still grew 3.5%. Varietals in 750 ml sizes were up 9.7%, while 1.5-liter sizes were up only 2.9%. Non-varietal 750s were the package type that had the overall highest growth rate for the four-week period, at 11.7%.

U.S. wineries haven’t yet seen any big invasion from Europe caused by the sinking euro. Imported table wines mostly sucked air in May, staying flat or dipping, with the notable exception of Argentina, which remained on a tear, posting 39.2% growth over last year. Domestic wines’ share of the U.S. off-premise market remained just under 79%.

Looking at overall varietal sales, including both domestic and imported, all varietals in the $20-and-up category showed double-digit growth. The hottest of all were Syrah/Shiraz at 39.9% up over last year, which must be good news for vintners who’ve been hearing that Syrah’s day is over. Fumé/Sauvignon Blanc showed almost as good a rate, 35.1% growth.

It was a rather broad expansion of higher priced red varietals, as red Zinfandel, Pinot Noir and Red Blends/Meritage all grew by double digits at all four price points from $8 up over the four weeks.

The sibling brands of Chateau Ste. Michelle, Columbia Crest and Red Diamond, are Nos. 1, 2 and 3 in dollar sales for Washington wines, with more than $85 million, nearly $61 million and more than $21 million for the 52 weeks measured..

In fourth place was Hogue Cellars, and in the fifth spot another Ste. Michelle brand, Columbia Crest Estate.

Our zoom-in on Washington’s top wine brands (see the accompanying table) shows that consumers didn’t boost sales all by themselves. Wineries are using various forms of merchandising to lower prices and get sales going. The state’s big Chateau Ste. Michelle brand used merchandising to lower its prices by 51 cents per bottle, and consumers apparently noticed, boosting sales by 8.9% in dollars over the same 52-week period a year ago.

Hogue Cellars, on the other hand, put fewer dollars into merchandising this year than last. Hogue’s 31-cent reduction per bottle may not have been enough, since its sales for the period dipped more than 4%.

“Merchandising is clearly driving volume right now,” Goodwin said. “Loyalty is lacking for consumers. What they are looking for is not the brand, but the price. They are not always going for the lowest price-points, but they are looking for a value, no matter what category they are looking in. I am seeing this all across the price spectrum.”

Figures quoted in this article come from the Chicago-based SymphonyIRI Group, which uses check stand scan data to provide market information and services to industries including consumer packaged goods, retail and health care. Wines & Vines provides further analysis and reporting on the results.

SHARE »

CURRENT NEWS INDEX »