Leading Flash Sales Sites Identified

Discount, time-urgent websites draw loyalty from consumers and wineries

“Flash” websites that sell wines at deep discounts for short times have become the darlings of many wine lovers, and they’ve attracted fans among wineries, too. The wine hobbyist’s interest is clear: Get wines at attractive prices and also have the thrill of the chase to acquire something special.

For wineries, however, the primary appeal is to unload unsold wine quickly without seeming to compromise the usual pricing among regular customers. Some wineries also believe that flash sites allow them to reach new wine drinkers—hopefully to return for more, and preferably at the regular prices.

Because of wineries’ interests in this new direct sales channel, Wines & Vines has initiated a major program to monitor and evaluate these sites and their successes as well as record everything in WinesVinesDATA. This program will include monthly coverage of the channel in the print magazine, reporting the number of wines offered, prices, discount percentages, typical wines offered, etc. Greater depth will be available online to subscribers only at winesandvines.com/flash.

Six sites seem to dominate the action, but they’re very different in character and operation. Most fundamentally, they divide into licensed retailers on one hand and on the other flash sites that say they act as advertising media for various wineries’ products. Some release only one wine per day, or at a time, while others feature a number of options.

| What is a flash site?

Wines & Vines is tracking numerous flash sites and outlines data from six of them in The Flash Report this month. |

318 wines in December

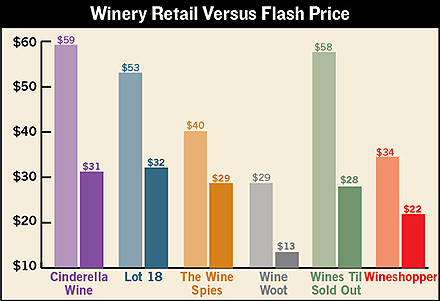

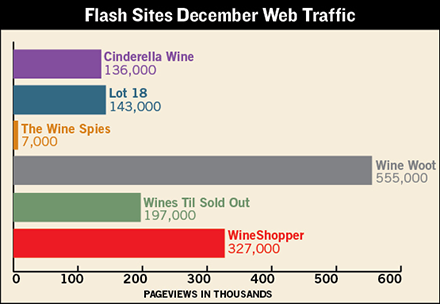

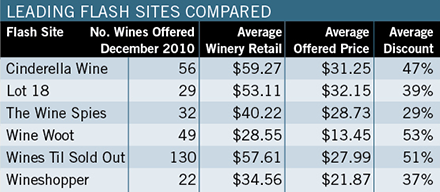

During the month of December, these six sites offered 318 wines at average discounts ranging from 29% by The Wine Spies to 53% by Wine Woot, according to WinesVinesDATA. Their web traffic was as low as 7,000 pageviews for The Wine Spies and as high as 555,000 for Wine Woot, reports Compete.com.

Wine Woot has developed a passionate user community since starting in 2006, but others are strictly retailers, some bare bones: Wines Til Sold Out refuses to identify its affiliation on its website and will only talk to customers via e-mail.

The wines offered differ, too. Most sites feature imported and U.S. wines, but Wine Woot is strictly domestic. Likewise, some discount deeply and may offer private labels while others stick to name brands and tout the wine’s quality and ratings more than minimal price. Most sites include ratings from various sources, though some may not be independent.

Some other flash websites offer occasional wines, like Rue La La, an invitation-only site associated with Wine Woot, and even wineries themselves are trying the technique.

Here’s a quick summary of each site Wines & Vines has identified as a leader.

Cinderella Wine is the flash outlet for Gary Vaynerchuk’s popular Wine Library retail store in New Jersey and Internet TV empire. The company is licensed as a retailer and says it sources wine only from distributors. Cinderella started with one wine per day, but now it generally releases one at noon and one at 9 p.m. Monday through Friday. Cinderella seems to sell mostly imports, though vice president of operations Brandon Warnke says Cinderella is just looking for good deals. Its average offered price was $31, and the average discount from the winery price was 47%. Some of the wines it has sold recently include Napa Valley wineries HdV and Alpha Omega, considered high-end brands.

Lot 18 is a venture of Philip James, founder of Snooth.com, which calls itself the world’s largest wine website, and Kevin Fortuna, a veteran technology entrepreneur. It is based in New York City with a procurement team in the California wine country. It acts as an advertising site and leaves shipping to its winery partners. It recently completed a $3 million round of funding led by FirstMark Capital, a New York City-based venture capital firm after a $500,000 seed round earlier this year. Its average offered price in December was $32, a 39% discount from winery retail. Wines offered have included some from California wineries De Loach, Raymond, Foley and Cornerstone.

WineShopper offers one to five products at a time, with five to six offers usually live at any one time. It is affiliated with Wine.com and touts heavy discounting from known brands, which are balanced between imports and domestic wines. Its principals are CEO Rich Bergsund and founder Mike Osborn. It is a licensed retailer based in San Francisco. Its average offered price in December was $22, a 37% discount. Domestic wines offered recently have included St. Supéry, Mumm Napa, Hahn, Round Pond, Raymond, Beaulieu and Robert Mondavi.

The Wine Spies offer one wine per day, almost all from California. This independent flash site is based in Santa Rosa, Calif., handles its own logistics and has a retail license. Its principals and co-founders are Jason Seeber and Brandon Stauber, who bill themselves as Agent Red and Agent White. Their average offered price in December was $29, a 29% discount from the original price.

Wines Til Sold Out is affiliated with Roger Wilco liquor store in Pennsauken, N.J. It offers one wine from around the world at a time for 30%-70% off suggested retail, shipping included. It typically offers up to four wines per day. The CEO is Joe Arking. Jonathan Newman, who served for years as chairman of the Pennsylvania Liquor Control Board, the largest buyer of wine and spirits in the United States, advises the company and supplies wine but has no financial stake in the site.

The flash site’s attitude might be called pure Jersey: no telephone calls, minimal customer service, take it or leave it. The offerings seem balanced between domestic and imports. The average discount from winery retail in December was 51%, and the average offered price was $28. Recently WTSO has sold a wide variety of brands including Kunde, Round Pond, St. Supéry, St. Francis, Charles Heidsieck and Piper Heidsieck, Sonoma Cutrer, Raymond, Hess, Mumm Napa, Beaulieu and Chateau St. Jean.

Wine Woot, which is affiliated with Woot.com, offers one wine each day. It acts as an advertising agent for the winery but not as the seller. The winery is the seller of record, but Wine Woot handles the logistics of shipping that wine, even picking it up from suppliers near its Santa Rosa site. Brothers David and George Studdert are the co-founders who approached Woot.com to set up the operation in 2005. It appears to be the pioneer flash site. Wine Woot has become a wine community as well as a sales site. Extensive dialogue between fans and winemakers takes place on the website, and users initiate local gatherings to taste wines and socialize. All wines are domestic, mostly from California. The average offered price in December was $62.

The wineries’ view

Wineries have mixed feelings about flash sales sites, as evidenced by their reluctance to talk about them either on- or off the record after a dozen calls to normally reliable contacts. Selling wines through the sites can upset distributors and retailers, some of whom pay more for the wines than the flash prices. Another concern is that regular consumers or wine club members might happen on flash sales at lower prices than what they have already paid, though most flash offerings have short exposures.

One well-placed winemaker/manager with extensive experience at a medium-size and a small winery, notes, “It’s an important tactic in these hard times, but it creates hard feelings with distributors. It’s a way to reduce inventory and raise cash. Some of these sites can take hundreds of cases of wine and sell them out in hours to minimize the time people might notice them.”

The manager, who prefers to remain anonymous, says the low prices hurt wineries, but the wineries supplying wines to flash sites don’t actually lose money on the deals. He adds, however, that the practice isn’t sustainable for a winery. It can’t continue to do this as a routine business practice. He adds, “It’s a sign of the future, and every crack in the distributor’s three-tier monopoly helps!”

One of the few winery officers who would talk said that working with The Wine Spies was a very good experience. “They pick up the wine and we don’t have a lot of paperwork, and they pay in three days.” Her winery has used the The Wine Spies six times and sold 25 to 60 cases each time; she added that an experience with Rue La La proved frustrating.

Chris Dearden, former manager and winemaker at Benessere in St. Helena, Calif., and now a consultant and vintner on his own, hasn’t used the flash sites but offers his opinion, “For the record, I believe that you erode the consumer base and it is sort of a rip-off to your wine club members to offer the wines on these flash sale sites unless you are going to offer the same thing to your members first.” He adds, however, “This has to be tempered with inventory concerns, I admit.”

Dearden says he thinks it would be better to make more by-the-glass options available and discount more heavily to distributors before using a flash site for an established brand. “But from what I understand, cash flow is a concern at some of these wineries, and they had to do it.”