Vineyard Economics: Sunny Forecast

Wine industry prospects are bright, seminar speakers report

This year, the mood was so ebullient that it surpassed even the positive results that organizer David Freed had collected in his Vineyard Economics Seminar Survey, compiled shortly before the conference. In that survey, 71% of those who responded had favorable attitudes about future growth, compared to 29% last year. Only 26% saw no growth, compared to 58% last year.

Economic conditions are still regarded as the most important factor affecting wine sales, hence grapes were of highest concern; but respondents put an emphasis on value among buyers in second place.

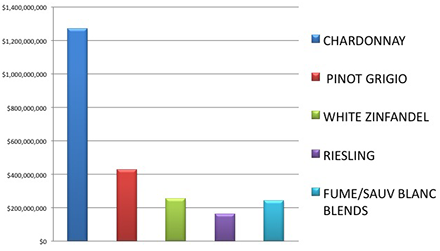

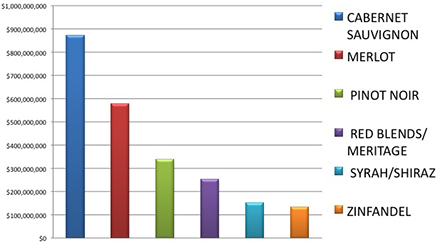

And while Chardonnay remains king of the market, with 53 million in cases last year, and Cabernet comes in at 33 million, according to Gomberg-Frederickson figures, red blends are exceptionally strong, even ahead of Merlot. “Just don’t call it Merlot or Syrah,” Freed cautioned, noting weak interest in those varieties.

Chardonnay and Cab continue to grow, but other varieties also face growing demand, noted Doug Goodwin of Symphony IRI Group, which tracks scanner sales from supermarkets.

Goodwin also said that producer names unfamiliar to most attendees —Tisdale, Liberty Creek (both Gallo labels) and Five Oaks—are now leaders among low-end wines in supermarkets.

Trinchero’s Menage à Trois and Gallo’s Apothic are the leading brands in the big $8 to $11 blended red category. In general, red blends are up almost 20%.

Pinot Noir also continues to grow, and is up about 11%.

As an indication of Muscat’s popularity, Nat DiBuduo of Allied Grape Growers told Wines & Vines that growers in his group have planted 400 acres of Muscat, and are planting 700 acres more this year—all under contract. Most is new planting; some is grafted, but double-grafted vines don’t usually have long productive lives.

DiBuduo noted that 16 tons per acre is a reasonable yield for the grape, and one grower expects to get 23 tons.

Business getting better

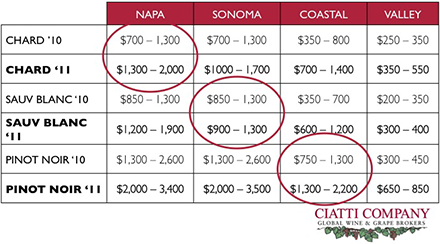

Glenn Proctor of Ciatti Wine Brokerage, which sells bulk wine and grapes, noted that business has been “fast and furious” the last four months after a long slowdown. “There’s good demand across the board.”

He said that Central Valley grapes are virtually all contracted, and the prices are up. The Central Coast has been “extremely” difficult the last two years, he said, but is seeing strong early demand for red varieties. “Chardonnay is difficult to sell.”

Proctor said that things are so tight in the Central Valley that buyers are looking at the Central Coast for supply. Unfortunately, he feels that prices are still not sustainable, but expects that to change with demand.

Prices are definitely up, however. Proctor is seeing Napa Cabernet Sauvignon at $2,400 to $4,000 on the spot market, compared to $1,000 to $2,800 last year.

He commented on strong early demand for Napa Cab, but said the market is driven by negociants and repositioned brands prices from $10 to $15.

Proctor warned, however, “Napa growers have to figure out how to produce wines at the prices that work for consumers.”

A panel of growers from various California regions talked about their situations; most agreed that things are better with both demand and prices climbing. But many noted that they’ve had to be flexible about contracts and prices.

From necessity, many growers are turning some of their fruit into bulk wine. Grapegrower Steve Sangiacomo said his family vineyards look at bulking wine as part of the business.

Rod Schatz in Acampo even built a custom-crush winery to handle both his overload and that of others, in addition to making some wines under his own brand, 15,000-case Peltier Station.

Still, the banker on the panel, Charles Day of Rabobank, is concerned about growers making bulk wine. “It can just put you further behind in cash flow.” Schatz emphasized that it must be part of a plan, not desperate speculation.

Not surprisingly, Joe Ciatti’s talk about buying and selling property gained rapt attention. The partner in Zepponi & Co., which advises buyers and sellers, said the company was involved in five deals totaling more than $110 million last year, and seven totaling $40 million already this year. Many other sales and mergers also occurred.

With the recent restructuring of Treasury Wines Estates, the wine arm of Foster’s, Ciatti expects action there, either acquisition of the whole company or of some of its parts. St. Helena’s 5-million-case Beringer is the most prominent. He expects deals this year to exceed $1 billion.

Ciatti noted that many signs point to more interest in buying wine properties: U.S. wine sales are continuing to grow, with more demand for both grapes and bulk wine. And in spite of the downturn, some major producers have prospered: 15-million-case Trinchero; 58-million-case The Wine Group; 3-million-case Delicato; 725,000-case Purple Wine Co., 12-million-case JFJ Bronco and 70-million-case Gallo, for example.

He predicted more buyers for vineyards, wineries and brands, including industry players, private equity and even a few lifestyle buyers returning to the picture. What he doesn’t see are large beverage companies buying—or dumb buyers or many bank foreclosures.

Ciatti commented that he observes a lot of activity behind the scenes, with four categories of properties interesting buyers:

Marquee brands and assets like 35,000-case Chalk Hill and 45,000-case Justin wineries and 15,000-case Showket and Bella Oaks vineyards are desirable and bring good prices.

Also in demand are assets with strong cash flow, including negociant brands like Echelon, which Purple Wine Co. can produce in its other facilities.

Vineyard assets, especially in the Central Valley—but elsewhere if good properties, are once again in demand—if they pencil out. “This was ugly a year ago, but is coming back,” Ciatti said.

Assets trading at discounted values are attractive. This may be because of lack of heirs, divorces, bankruptcy or other financial problems. Even weak performers may sell, if buyers see ways to improve performance.

Ciatti said drivers of the merger and acquisition activity include “owner fatigue”—tired of the hard work—lack of succession planning, financial duress and pressure by lenders concerned about excessive debt or poor performance.

Pope Valley properties sell

At the conference, Wines & Vines learned privately about one deal: A private investor from Vancouver, Jerry Bordian, bought both Norm Alumbaugh’s 20,000-case Eagle and Rose Estate, winery and home (plus an airport left over from World War II) and the nearby former Cosentino CE2V property, both in Pope Valley in Napa County. Scott Brown, who owns James Creek Vineyards, will manage the properties.

We also learned that Jan and Bart Krupp, who own the renowned 1,100-acre, 6,000-case Stagecoach Vineyards and adjoining Krupp Vineyards and Krupp Brothers Vineyards in the Atlas Peak AVA, have acquired land on Silverado Trail across from the Silverado Wine Studio. The property contains a small vineyard and home. The latter will become a tasting room for Krupp Brothers Vineyards wines. Because the property is larger than 10 acres, Dr. Jan Krupp said they will also seek to build a winery; the wines are now made at Laird custom-crush winery.

If one cloud hung over the seminar, it was the specter of discounting. “We’re concerned about discounting,” said Tom McComas of Bank of America, a sentiment echoed by many speakers.

A balanced market might end that concern—and it seems that we’re on our way to that situation.

The 20th annual Wine Industry Financial Symposium will be held Sept. 19-20 at the Napa Valley Marriott. winesymposium.com.

SHARE »

CURRENT NEWS INDEX »