Domestic Wine Sales Up

Import market flat; high-priced bottles, boxes grow fastest

“October is traditionally one of the two low points of the year, so for domestic table wine sales to be up more than $19 million is a very positive point,” said Doug Goodwin, SIRI’s VP of client insights for beer, wine and spirits. He observed that sales were down from the previous four weeks, but noted that is normal, since early September sales are boosted by the Labor Day holiday, while October has no holiday until Halloween, which did not fall within the four weeks measured.

“If I were a winery, I’d start looking for a holiday to help promote wine sales in that period,” Goodwin suggested.

$20 wines grew 22%

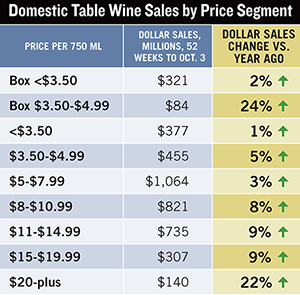

Wines & Vines also looked at the 52-week performance of retail sales, as recorded by SIRI from store check-stand scan data. Dollar sales for the whole domestic table wine category grew 6% over this longer period, for a total of $4.3 billion. Within that total, the highest priced wines, at $20 and above, posted 22% growth over 52 weeks. The growth came at the cost of an average 99-cent price reduction per bottle.

While impressive, the $20 segment’s performance doesn’t tell the whole story. Wines retailing for $5-$7.99 took the biggest dollar share of the market with more than $1 billion in sales. These grew a modest 3% over 52 weeks, while their volume grew 5%, meaning the average price came down, but only by 13 cents per bottle.

Box wines up 24% in dollars

The next three rungs up the price ladder grew faster, at 8%, 9% and 9%, also with accompanying volume growth and slightly lower prices. Higher-priced box wines, those from $14 to $20 per 3L box, had the best growth rate of all at 24% in dollar sales.

In a recessionary market where the lowest priced wines have attracted a lot of media attention, it’s interesting to note that over 52 weeks the two slowest rates of growth occurred precisely in those categories. The least expensive box wines and bottled wines added together accounted for fewer dollars than four other higher-priced segments in the SIRI data.

Oregon table wines at 11% grew faster over 52 weeks than California at 6% and Washington at 4%. The fastest growing import countries were Argentina, New Zealand and Spain.

SHARE »

CURRENT NEWS INDEX »