B.C. Winery Clusters Not Congealing

University report says British Columbia wineries suffer from failure to communicate

Based on interviews and surveys conducted with 33 winemakers and 20 industry representatives last summer, Dr. Anil (Andy) Hira, a professor of political science at SFU, concluded that the maturation of the wine industry in British Columbia’s Okanagan Valley has yet to yield a sustainable cluster.

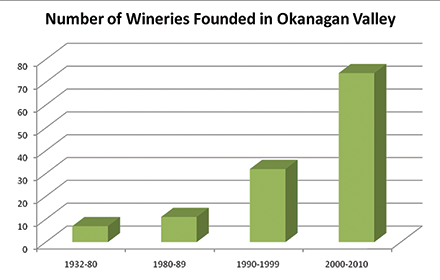

“The industry is more of a proto-cluster, with key issues stemming from a lack of organization, coordination and policy foresight,” concludes the report, The Wine Industry in British Columbia: A Closed Wine but Ready for Harvest, written by Hira and graduate student Alexis Bwenge. B.C.’s industry has seen tremendous growth during the past 20 years, and today it boasts approximately 10,000 acres of vines. But the report paints a picture of a successful industry that has grown up in the shadow of a protective government. This helped limit development of policies that could strengthen the industry, and in turn left it vulnerable to crises that could be addressed through foresight and planning.

“The literature tells us that major policy change does not occur unless there is a crisis,” Hira wrote. “This policy paper hopes to catalyze forces that might prove otherwise, and suggests places to start before that unhappy circumstance arises.”

B.C. industry remains fragmented

While illustrating many key features of a thriving industrial cluster—such as favorable geography, policy and collaboration—the sector is in fact fragmented and requires aggressive long-range planning to reduce the risk of growing pains, according to the report.

“The foundations of that growth are vulnerable to all kinds of factor changes, changes in markets, changes in institutions as well as just general saturation in terms of the number of producers and costs of inputs,” Hira told Wines & Vines. “I think one of the most striking things I found was that just when you start to look at other wine clusters around the world, the lack of proactive institutional support—both in terms of industry associations as well as public policy—is really astonishing.”

Hira noted specific vulnerabilities in the industry, including saturation of the market for B.C. wine; rising land and input costs; dependence on regulatory protection; a strong reliance on tourism and lack of alternative markets; difficulties pursuing export opportunities; lack of industry coordination, including poor coordination of supply chains, and lack of effective media for disseminating research and knowledge.

While the economic challenges facing the industry are significant, Hira was particularly troubled by the insularity of the industry. Shallow social networks have limited the cluster of wineries in the Okanagan to small pockets, including those seeking subappellation status for their areas (these include the so-called Golden Mile area south of Oliver and the Naramata Bench wineries). These wineries are typically within a 20-minute drive from each other.

The lack of deep social networks is echoed in a disconnection Hira noted among local researchers and research institutions. “There is little coordination between PARC (Pacific Agri-food Research Centre in Summerland) and UBC’s Wine Research Centre,” Hira wrote. “PARC’s policy of controlling 100% of all intellectual property disseminating from its research efforts, even if collaborative, effectively prohibits research with UBC.”

While one winemaker told Hira that the UBC Wine Research Centre at UBC’s main campus in Vancouver could deliver a significant service by posting its latest research online, most of the winemakers Hira interviewed are still unfamiliar with the center or its research program.

“Several interviewees suggested that the Wine Research Centre relocate to Kelowna, but the real problem seems to be a lack of a middleman to translate what the cutting edge research in grapegrowing and winemaking is to the average winery,” he said.

Indeed, almost all respondents told Hira that independent consultants and product suppliers such as Cellar Tek are among their most important sources of information. Government researchers and universities remain marginal sources of extension support, Hira found.

“When you look at the interest that they have in information and information dissemination, it’s quite high,” Hira said. “But it seems that they’ve all relied either on their own means of getting that information and applying it to their wineries, or they’re relying on consultants. That’s a very haphazard way because, obviously, you’re not sharing information that way.”

Hira’s study was funded by Genome Canada and Genome BC as part of a larger project regarding grape and wine genomics. (See “Attitudes Toward Wine Technology Studied.”)

Initial response to Hira’s report from winemakers and industry representatives interviewed for the project has been favorable. The second phase of the project, to be completed between this year, will seek ways to address industry’s vulnerabilities. Hira hoped to assemble a panel of international experts at the annual conference of the B.C. Wine Grape Council in Penticton this summer to discuss the industry’s competitiveness.

The experts from Australia, Chile, Italy and Spain are conducting similar research in their own countries, which will eventually be assembled with the findings from B.C. in a book.

SHARE »

The BC Wine Institute’s (BCWI) volunteer membership represents 95% of BC VQA sales, 95% of the total wine production in the province and produce 88% of 100% BC grape wine production. Wholly supported through member sales, the BCWI represents the interests of BC VQA wine producers in the marketing, communication and advocacy of their products to all stakeholders. Whether in partnership with the BCLDB, its 21 BC VQA wine stores, the export market via the Canadian Vintners Association (CVA) or tourism and media stakeholders, the BCWI strives to provide leadership for the BC wine industry.