Vineyard Owners Get Hints

At NVG seminar, speakers discuss estate planning, replanting and sales

This year, the seminar was held at Trinchero Napa Valley’s new facility north of St. Helena. Its attendees ranged from owners of tiny vineyards around their homes to major landowners.

This year, it focused on farm plans, when to replant, optimizing the value of your vineyard and estate planning.

The meeting began on a somber note as incoming NVG president David Beckstoffer outlined the threats to Napa Valley vineyards, including challenging times for their winery customers and pressures from some quarters to expand commercial activities at wineries to boost the local economy.

He emphasized, “Courts and legislation aren’t the best way to protect our agriculture. More important is giving an economic incentive to own and farm vineyards.”

Grower Randy Snowden of Snowden Vineyards then provided a pep talk to growers about all the good things about Napa Valley and its grapes. The rest of the seminar discussed various sides of how to make grape growing more successful, and how to take advantage of that success.

Urgency on estate planning

As often occurs at these seminars, the amount of valuable information presented was almost overwhelming -- especially in the area of estate planning, which can baffle even the most technically competent.

To start with that topic, the most important message is that this year is likely a short window with unparalleled circumstances. This year there is no estate tax, and hence unlimited estate tax exemption; the gift tax rate is only 35%, and there is no generation-skipping transfer tax.

By contrast, last year the estate tax exemption was $3.5 million; the estate tax rate was 45% on assets over $3.5 million; the gift tax rate was 45%, and the generation skipping transfer tax was 45%.

This year’s unique plan is due to expire this year, however, and taxes will revert to the former high levels unless Congress acts -- and there’s no sign it will: The state tax exemption drops to $1 million; the estate tax rate returns to 55% on assets exceeding $1 million; the gift tax rate goes back to 45%; the generation-skipping transfer tax rises to 55%, and the old rules that all assets get an increase in basis at death come back.

Though no one plans to die this year to take advantage of the current rules, vineyard (and winery) owners can take steps to reduce future tax burdens on their successors. Dave Gaw of Gaw Van Male also outlined many arcane strategies to reduce taxes on estates. He also encouraged everyone to meet with his or her estate planner soon.

The value of farm plans

On a more positive note, a number of speakers outlined the value and important of developing farming plans for growers to develop with their winery customers.

Long-time grower Zach Berkowitz started with an intensive summary of best grapegrowing practices. Challenging some conventional wisdom, he emphasized that winemakers may encourage trendy practices that reduce yield, often with no increase in quality.

Stan Zervas of Silverado Farming Co., whose company farms 35 vineyards, focused on working with vineyard management companies. He noted that top winemakers used to say, “Do anything to improve quality. I can always increase my wine’s price.” With current economic conditions, they’re saying, “We want the best quality we can get at the price.”

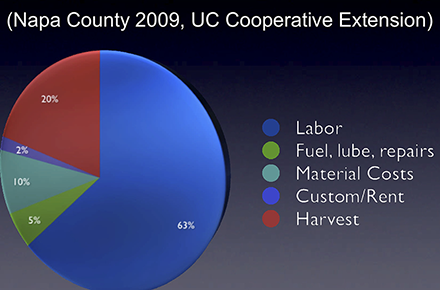

He and other panelists pointed out things that growers can do to save money and not compromise quality, like removing undesirable fruit including shoulders and wings in one pass instead of multiple passes, as well as shoot-thinning once early in the season.

Another panelist, Jim Verhey, who owns a small vineyard and also manages giant Silverado Winegrowers (no relation to Silverado Farming) mentioned weeds that don’t affect quality. Likewise, Zervas mentioned an owner who really wanted beautiful landscaping: “I want it to look like a vineyard!”

Verhey, like other growers, mentioned that lower yields don’t necessarily mean better quality, as some wine critics believe. There’s an optimum for a site and variety, and it may be far more than often suggested. Jerry Lohr of J. Lohr Vineyards, which owns almost 3,000 acres including some in Napa Valley, discussed the extensive steps he takes in replanting. “I bought 35 parcels and have planted or replanted them all,” he said. “I’ve made my share of mistakes.” He reminded attendees that if they replant, they have to be able to stand the negative cash flow, and this may not be the best time to do that.

It’s been about 20 to 25 years since most Napa Valley vineyards had to be replanted because phylloxera-sensitive rootstocks were failing. Replanting is an expensive process, and audience members quoted $20,000 to $30,000 per acre on level land, but Mark Battany, the farm advisor for San Luis Obispo and Santa Barbara Counties, pointed out that it’s often possible to coax many additional years of productivity, albeit dropping, in the face on many conditions like canker, viruses, or to graft unsuitable or unpopular varieties and change configurations to improve quality.

Some problems do require replanting, notably incorrect rootstocks, and probably some areas simply aren’t suitable for quality vines. He emphasizes planting clean nursery stock, however. Battany said it’s now available from commercial nurseries, and he avoids using field budwood that could have problems.

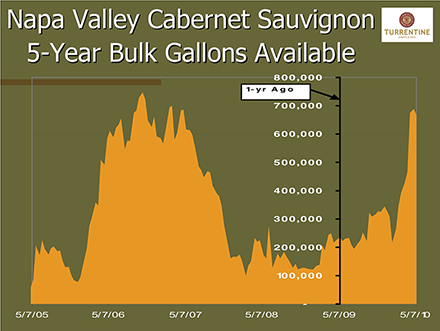

Wine and grape broker Bill Turrentine had the unenviable task of suggesting what varieties to plant based on his company’s bulk-wine inventory and predictions of future demand balanced against present supply.

His top choices:

1. “Anything with the right contract!”

2. Cabernet Sauvignon

3. Chardonnay

4. Pinot Noir

5. Merlot

Additionally, John Fisher of investment banker Fisher & Co. pointed out that the key to gaining great value for your grapes is not just objective quality, but reputation. “‘First’ and ‘different’ are more valuable than ‘better,’” he noted, repeating the old marketing principle of positioning.

“Great vineyards make consistently great wines (or supply makers of great wines). They also have great stories to tell about their uniqueness. They enjoy designations, associations and endorsements. And they’re rewarded by higher revenues over costs on longer-term contracts. They depend less for value on ‘comparable vales,’ more on what specific buyers are willing to pay,” stated Fisher.

His talk raised many questions of how vineyard owners could favorably differentiate their brands, though few answers were covered in this session. The organization had covered that subject in earlier seminars that featured leading vineyard owners like Lee Hudson.

However another by Katherine Philippakis, of law from Farella, Braun + Martel, outlined ways to extract cash from vineyards even if this is not the ideal time to sell. They included finding willing lenders, various leas-back schemes and adjusting parcels. She, too, emphasized, “The best strategy is to grow grapes so desirable that someone will pay a lot for your vineyard.”

SHARE »

CURRENT NEWS INDEX »